Just Harvest Free Tax Prep program staff and volunteers at PHDC in 2023: (from left) Elaina Mitchell, Fern, Jimena Willey, Alina, Yolanda, Samatha

Thanks to our staff member Jimena Willey, Just Harvest now offers free tax preparation in Spanish through our newest tax site at the Pittsburgh Hispanic Development Corporation in Beechview from 10:00 a.m. to 4:00 p.m. on Mondays.

Jimena has helped to train three tax greeters, a tax preparer, and tax reviewer so that Spanish-speaking immigrants are able to get IRS-certified help filing their taxes.

Immigrants to the U.S. don’t have a Social Security number until they become residents or citizens, which typically takes years. So they need to get an Individual Taxpayer Identification Number (ITIN) from the IRS to pay taxes on their earnings.

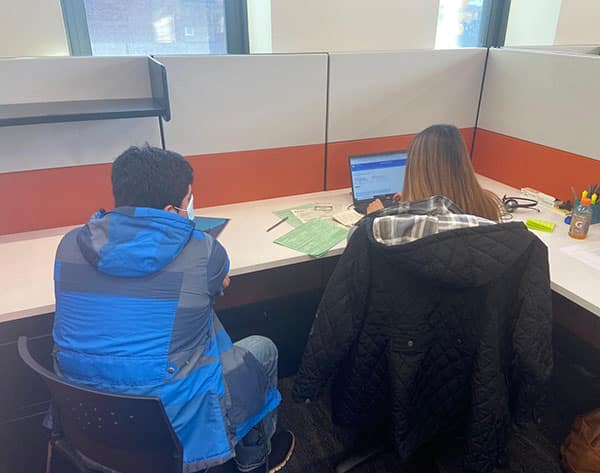

Jimena helps a tax client at our site at PHDC

An ITIN won’t make them eligible for many of the public benefits and protections that their taxes help pay for, like SNAP, TANF, unemployment insurance, disability insurance, Medicare, and Social Security. An ITIN won’t even allow them to access key tax benefits like the Earned Income Tax Credit or the stimulus payments that went out during the pandemic. And despite being taxpayers, they won’t have the same rights and opportunities as American citizens, like the right to vote or get a driver’s license.

But having an ITIN demonstrates to the government that they are obeying federal tax laws, documents their work history and contributions to the economy, allows them and their children to apply for health care coverage through the Affordable Care Act, and helps bring them closer to becoming United States citizens. The ITIN application assistance we provide along with our free tax preparation helps them navigate the complex and intimidating IRS bureaucracy, and saves them from having to go to the IRS building and wait hours for their application to be reviewed.

This fall, Jimena also joined our Food Stamp team, answering Spanish speakers’ questions about SNAP and helping those who are eligible or have eligible children to apply. After years as a Just Harvest tax preparer, she is thrilled to now also bring her SNAP expertise to Spanish-speaking tax clients. “I’m so happy at how much our site has grown and all the people we’re reaching. It’s making such a difference in their lives.”

No comments yet.