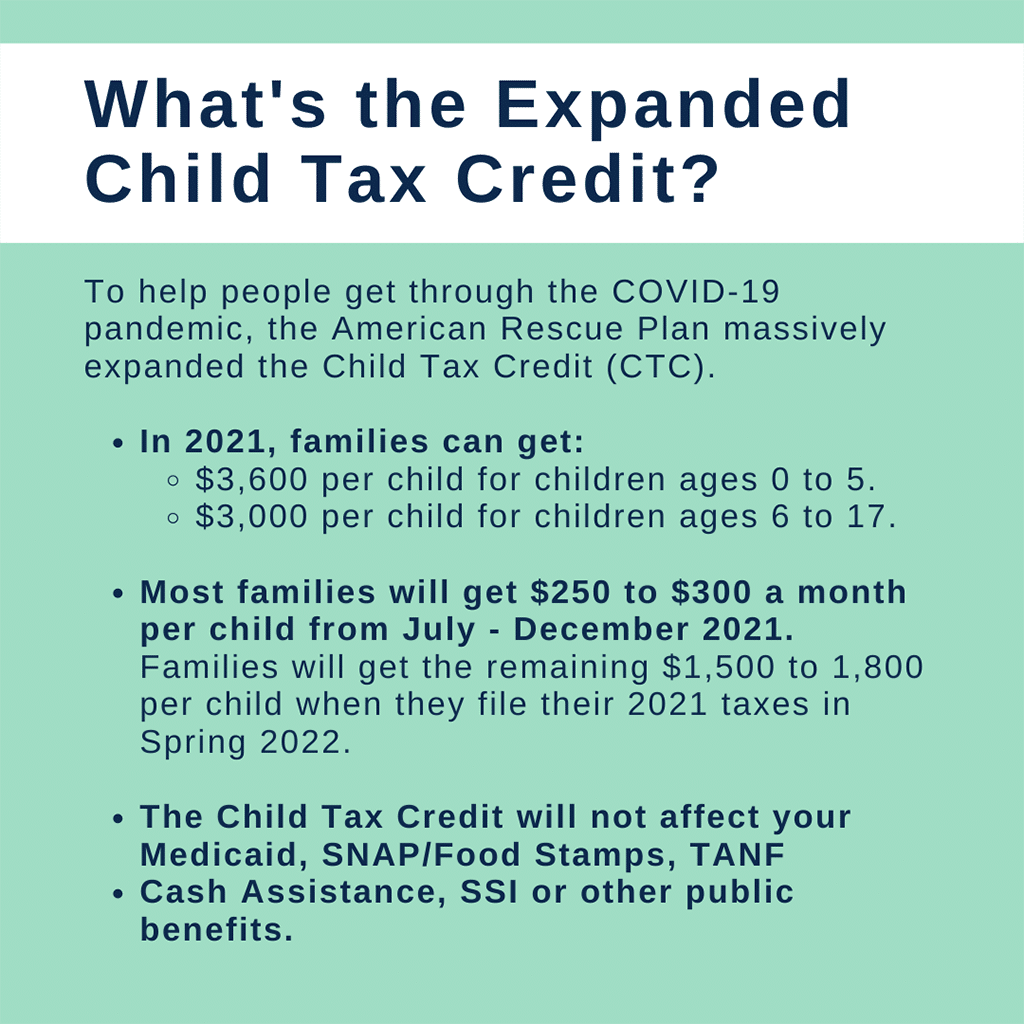

The changes to the 2021 Child Tax Credit (CTC) could mean you are eligible for the credit, even if you do not usually file a tax return.

The changes to the 2021 Child Tax Credit (CTC) could mean you are eligible for the credit, even if you do not usually file a tax return.

The temporary expansion of the CTC has helped people through the COVID-19 pandemic and lifted millions of children out of poverty.

Every family that is eligible for CTC must file a 2021 tax return to claim the remaining half of the credit. Find free tax help options here.

Review the Frequently Asked Questions below to learn more about getting the expanded CTC.

Who is eligible?

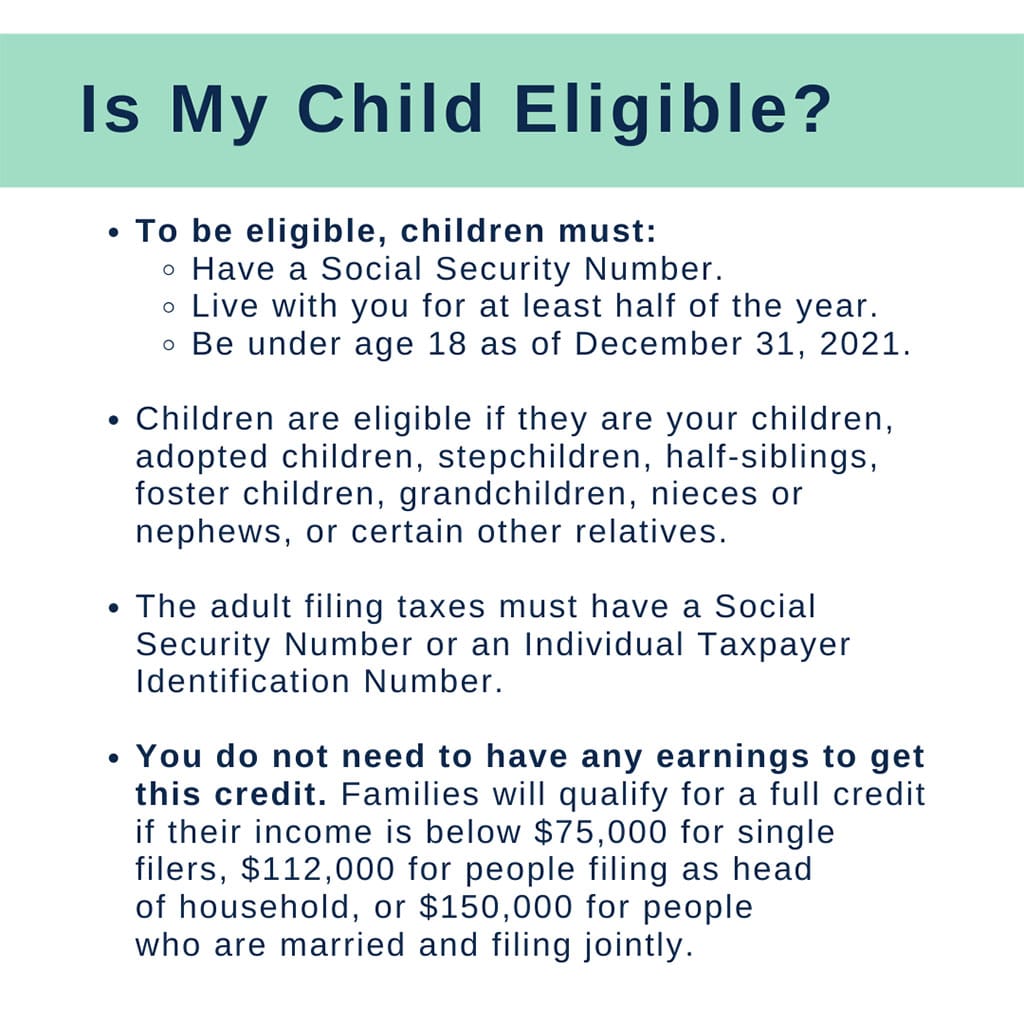

There is no minimum income requirement for the Child Tax Credit. This means that an individual with zero income is still eligible to receive CTC. Individuals with income higher than $75,000 will receive a reduced amount ($112,500 for Head of Household, and $150,000 for married couples).

The taxpayer (and spouse) must have either a social security number or an ITIN. You also must have a “qualifying child” to be eligible to receive CTC, and the child must have a social security number.

Who does the IRS consider a “qualifying child?”

A qualifying child for CTC could be your child, grandchild, stepchild or adopted child; younger sibling, step-sibling, half-sibling, or their descendent; or a foster child placed with you by a government agency. The child must be 17 years old or younger on 12/31/2021.

A qualifying child must be considered your dependent on your 2021 tax return. This means that they lived with you for more than 6 months in 2021, and the child did not provide over half of their own support. Only one taxpayer can claim a child for CTC, and payments cannot be split between more than one tax return.

How much could I receive?

How much could I receive?

The maximum total amount of CTC for 2021 is $3,000 per child under 18 years old and $3,600 per child under 6 years old. This amount begins to decrease when an individual has income higher than $75,000 ($112,500 for Head of Household and $150,000 for married couples).

The expanded CTC is for your 2021 tax return (which you file in 2022). The advance payments will give you up to half of your CTC amount in 2021. Then, you will have to claim the rest of it by filing a tax return in 2022.

When will the IRS begin issuing advance CTC payments, and what do I need to do to receive them?

The first advance CTC payments will be issued on July 15th, then on the 15th of every month until December 2021.

- If you filed a 2019 or 2020 tax return, the IRS should have automatically issued your payments in July based on the information on your return.

- If you did not file a tax return and you are not required to file, you must file a 2021 tax return to claim the full CTC amount.

I am eligible for the CTC but did not receive advance payments or did not receive the full amount. What should I do next?

Any missed payments can be claimed on your 2021 tax return (the one you file in 2022) and will be added into your tax refund. This also applies to families with children born in 2021. When preparing your taxes, you will need to know the amounts for payments you did receive (if any) to make sure this calculation is done correctly.

Eligible families have until April 2025 to file a 2021 tax return and claim the Child Tax Credit. It’s best to file as soon as possible to avoid complications or delays in processing the tax return. Learn how you can get free help with your taxes.

I did receive advance payments, where can I find my payment history?

The IRS is issuing letters to all families that received these payments and you should use this letter when preparing your tax return. If you can’t find the letter, you can also access your payment history by creating an account on the IRS website.

I received payments, but do not think I was eligible. Will I have to repay the IRS?

A family may receive the wrong amounts for advance payments if their income increased significantly in 2021 or their family size changed, and they did not opt out of payments. However, there are some protections in place for lower-income households:

- Full repayment protection for Single filers under $40,000, Heads of Household under $50,000, Married Filing Jointly under $60,000

- Partial repayment protection for Single filers under $80,000, Heads of Household under $100,000, Married Filing Jointly under $120,000

- No repayment protection if income is over partial repayment protection limits

Looking for more information?

See our pages for information on the first and second economic impact payment, the American Rescue Plan Act and third economic impact payment, or on virtual tax preparation.

You can also view up-to-date EIP and CTC information from the Center on Budget and Policy Priorities.

No comments yet.