- Just Harvest’s tax preparation sites are open from January 22 – April 15

- To schedule an appointment, visit pa211.org/VITA

- ¿Necesitas ayuda en español? ¡Haga click aquí!

About our Free Tax Prep Program

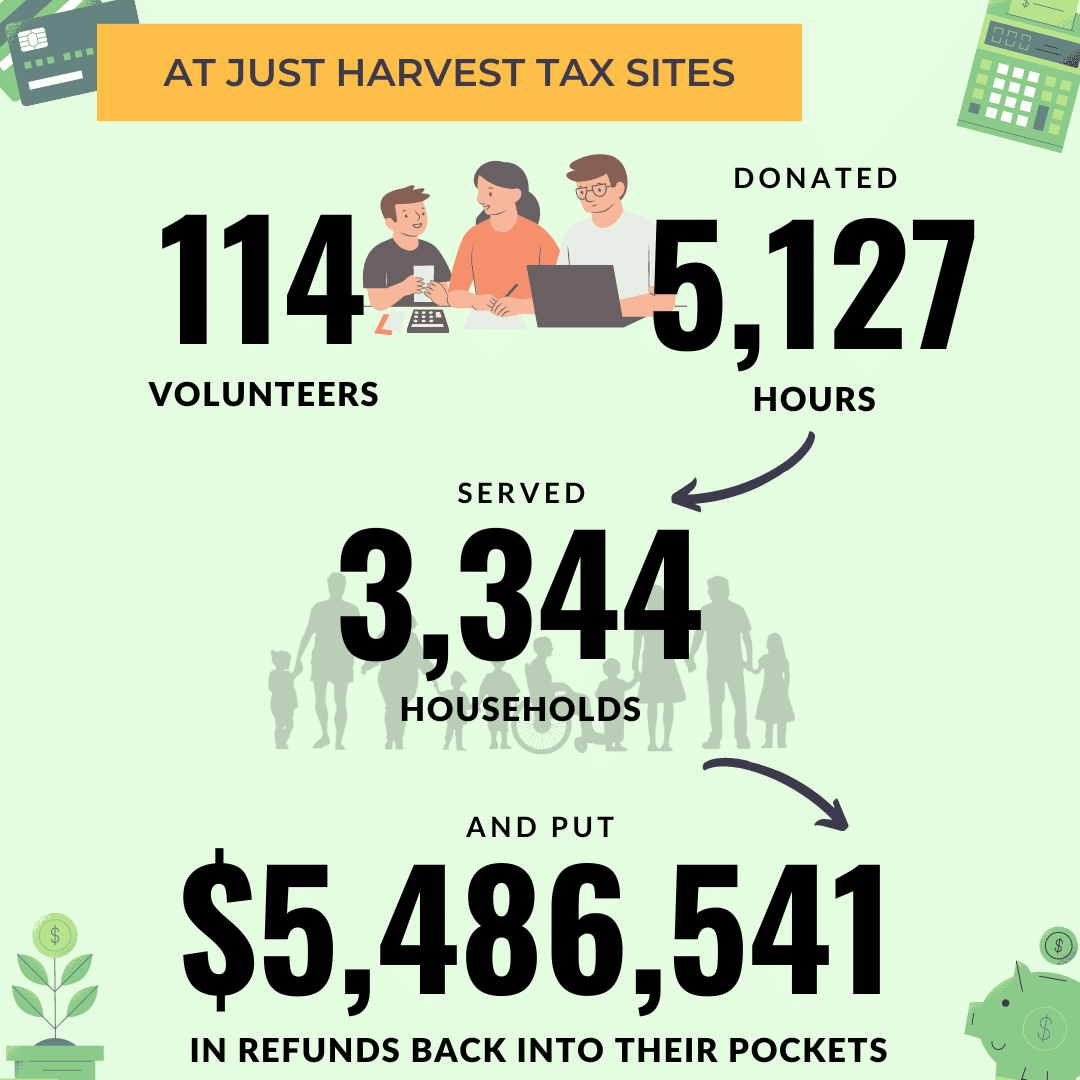

Every year, Just Harvest helps low-income households file their income tax returns and maximize their tax refund. Launched in 2003, Just Harvest’s free IRS-certified tax return preparation service is now one of the largest in Pennsylvania.

Just Harvest also manages the Free Tax Preparation Coalition (sponsored by United Way of Southwestern PA), which provides free income tax return preparation throughout the region.

We are committed to providing high-quality free tax preparation to allow workers to keep the tax credits they’ve earned, not lose them to tax preparation fees and advance refund loans.

Our program has continuously expanded to meet the needs of communities in the Pittsburgh area. We have four tax sites that offer in-person tax help, ITIN application assistance, and interpretation services for Pittsburgh’s growing immigrant communities.

Need Help With Your Taxes?

Schedule a tax appointment

To schedule a tax appointment with the Free Tax Prep Coalition tax site that is closest to you, you can contact the United Way Resource Navigators in 3 different ways:

- Dial 2-1-1 or 888-856-2773

- Text your zip code to 898-211

- Click here to use our online scheduler to make an appointment

File taxes with help

- Free online tax preparation is available until October at GetYourRefund.org

- This option is available for those with income less than $65,000 in 2023

Prepare your own tax return

Use Direct File from the IRS to file your federal and state tax returns

- A free option with no income limit

- To see if you are eligible, visit the Direct File website

Use MyFreeTaxes.com

- Free for households with less than $83,000 of 2024 income.

- Refer to our DIY tax preparation guide to get started.

- Learn if this option is right for you.

Ask a question

Need a copy of your tax records?

If Just Harvest did your taxes in a previous year, we can get you copies of your tax records or prior year AGIs. Please call (412) 431-8960 x212 or send an email that includes your name and the last 4 digits of your SSN to taxhelp@justharvest.org. You can also go to www.irs.gov/individuals/get-transcript to obtain an online transcript of your tax returns from the IRS.