The federal Earned Income Tax Credit is possibly the largest federal anti-poverty program in the country, and, many would say, the most effective.

The federal Earned Income Tax Credit is possibly the largest federal anti-poverty program in the country, and, many would say, the most effective.

Every year, the federal EITC returns thousands of dollars to eligible low- and middle-income households when they file their taxes. Because it’s fully refundable, households can receive the credit even if they make too little to pay taxes. For many recipients, the EITC is a significant chunk of income and can even lift them out of poverty. That’s why 28 states, Washington DC, and New York City now have their own EITC.

So we’re thrilled that all the Democrats and 20 Republicans in the Pennsylvania House of Representatives passed HB1272, which would create a state Earned Income Tax Credit for some working Pennsylvanians. HB1272 now goes to the Pennsylvania Senate for consideration.

Contact your state senator now to urge them to pass a state EITC!

Contact your state senator now to urge them to pass a state EITC!

Who the EITC helps

In 2018, the EITC lifted about 5.6 million Americans above the poverty line, including nearly 3 million children, and reduced the poverty of another 16.5 million people, including about 6 million children. Research shows the EITC provides a host of other benefits to recipients and to children, as well as to their local economy, just by putting more dollars in their pockets.

Tax credits like the EITC and Child Tax Credit, targeted at low- and moderate-income households, not only reward work but they save all taxpayers money and improve their lives by addressing poverty in our society. Poverty costs us all a lot in both dollars spent dealing with its effects (poor health, crime, low education outcomes, etc.) and the growth and opportunities lost when people can’t reach their potential.

Tax credits for low- and middle-income households also return some badly needed fairness to a tax system that is rigged to provide huge tax breaks for wealthy individuals and corporations, and a federal government (Congress) that often increases and extends those tax breaks (to no benefit for the rest of us). These systems encourage tax evasion by the wealthy while IRS algorithms disproportionately target people in poverty and people of color. At a state level, Pennsylvania has the 7th most regressive tax system in the country, though the vast majority of states have state and local tax systems that worsen inequality.

One could say that a state EITC, as provided for in HB1272, is the least we could do to correct this.

What would a state EITC give recipients?

HB1272 would create an additional EITC for 1.4 million hard-working Pennsylvanians who would qualify for it. The United Way reports that this portion of the PA population – folks who are Asset Limited, Income Constrained and Employed (ALICE) and can’t afford basic needs like housing, childcare and food – has grown in recent years due to job disruption and inflation.

HB1272 would create an additional EITC for 1.4 million hard-working Pennsylvanians who would qualify for it. The United Way reports that this portion of the PA population – folks who are Asset Limited, Income Constrained and Employed (ALICE) and can’t afford basic needs like housing, childcare and food – has grown in recent years due to job disruption and inflation.

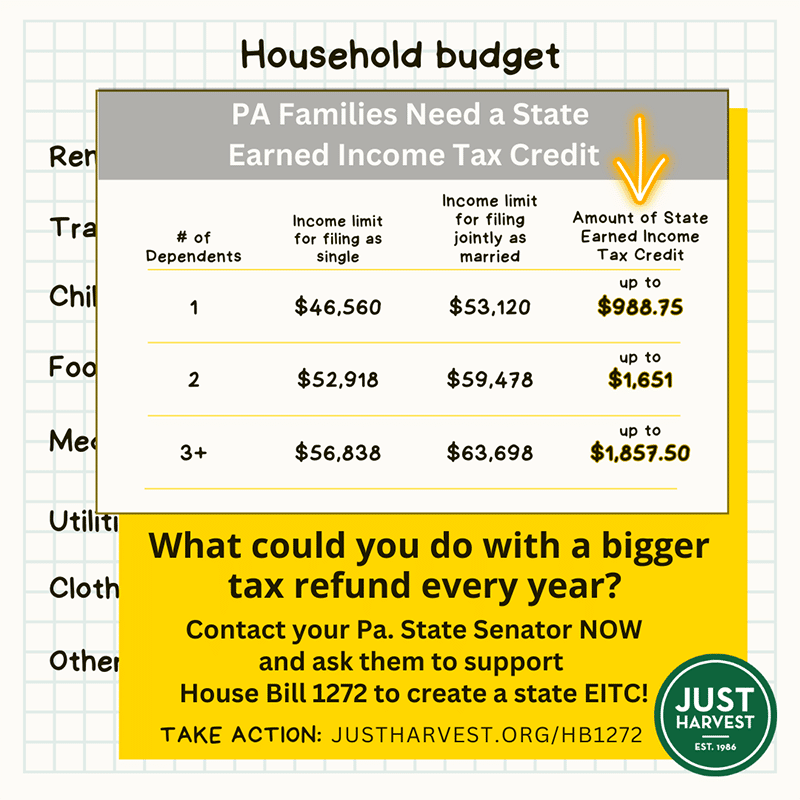

Unlike the federal EITC, HB1272’s state EITC would only be accessible for those with children. The tax credit it provides would be 25% of the federal EITC amounts. If the Senate passes this bill, for eligible Pennsylvania families who work and earned less than $63,698 in 2023, when they file their income taxes in 2024, they could get:

- up to $988.75 if they claim one child,

- up to $1,651 if they claim two children, or

- up to $1,857.50 if they claim three or more children.

(See the graphic for the specific income limits; click to enlarge.)

Having a state EITC might also help make the 1 in 5 who are eligible for federal EITC but fail to claim it more aware of this fantastic way to boost their income. Use the IRS’s EITC Assistant to see if you’re eligible for the federal EITC here. Under the bill the PA state legislature is now considering, your state EITC would be 25% of whatever you’re eligible for on the federal EITC.

That said, younger and older low-income adults, who are less apt to have children, will likely not be helped by this bill. We would want the legislature to improve this legislation as soon as possible by making the state EITC accessible to childless households as well as immigrant workers who pay their taxes using an ITIN. All low-income workers deserve a tax break.

What would a state EITC give PA?

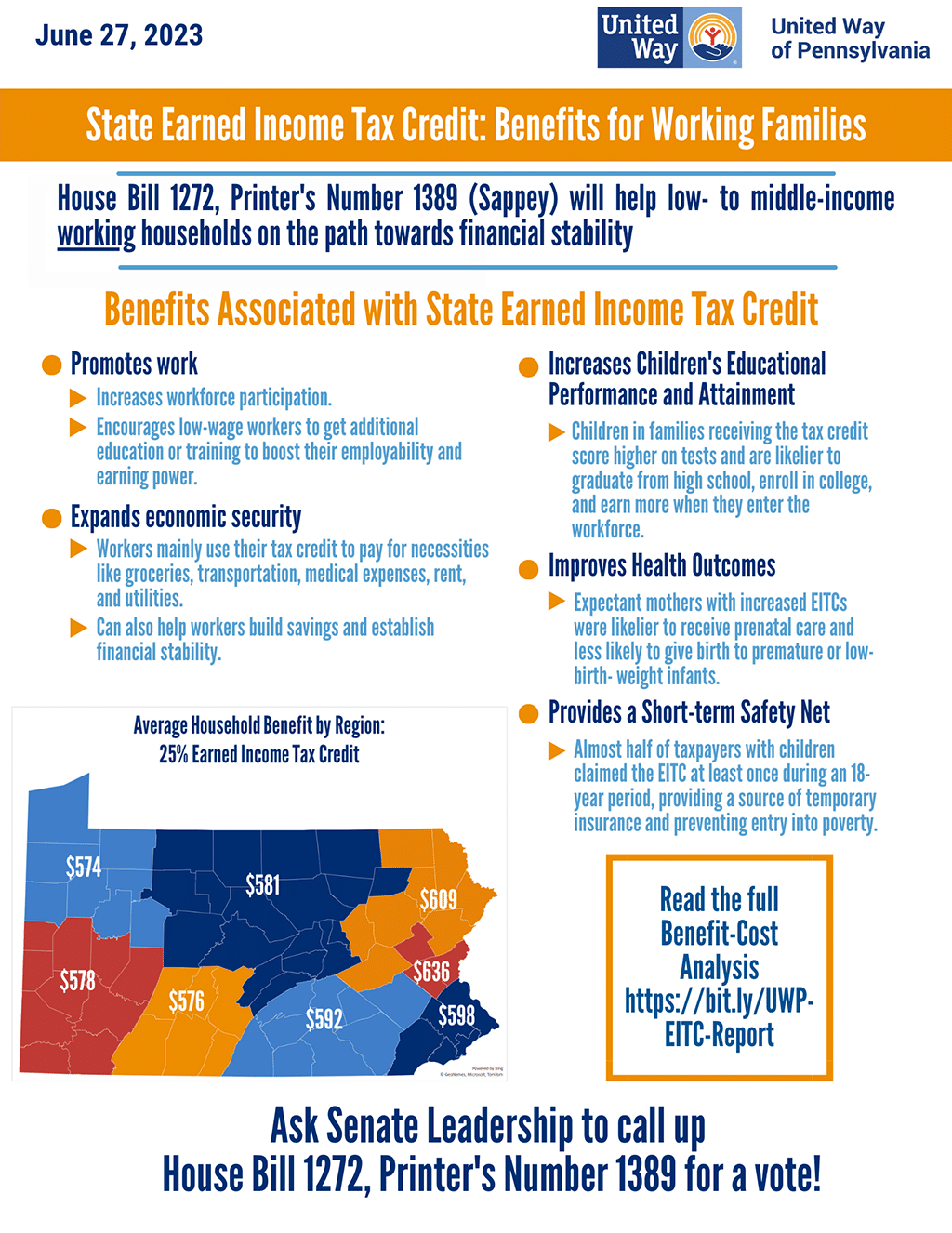

The benefits of a state EITC are numerous. Although the administrative cost of implementing an EITC would have a negative impact on the budget initially, the payoff in terms of enhanced wealth and benefits is far larger. A United Way cost-benefit analysis found that other than the initial investment of administrative funds, a state EITC would pay for itself by boosting the economy and reducing the need for human services spending.

The benefits of a state EITC are numerous. Although the administrative cost of implementing an EITC would have a negative impact on the budget initially, the payoff in terms of enhanced wealth and benefits is far larger. A United Way cost-benefit analysis found that other than the initial investment of administrative funds, a state EITC would pay for itself by boosting the economy and reducing the need for human services spending.

- The fiscal savings would be $965.6 million in increased tax revenue and reduced public assistance spending.

- Total savings would be $1.18 billion through the avoidance of additional short-term state human services costs (like on low-birthweight hospitalized babies, special education, foster care entry, crime and public safety, child health coverage).

- Long-term human services cost avoidance (the above plus improved infant mortality rates, educational attainment, and adult suicide prevention) would allow savings to balloon to $2.75 billion.

That’s a total long-term return on investment of nearly 660% and a wide array of benefits for working Pennsylvanian families. It’s almost like you’d have to be stupid not to support this.

How you can help get a state EITC

Like we mentioned, the House has done its job and passed the bill, HB1272, which would provide for a state EITC. Now it’s up to the Senate to do the same!

![]() Contact your state senator and urge them to support HB1272 (Printer’s Number 1389) by asking their leadership to call it up for a vote. Ask them to vote YES once it reaches the Senate floor. Tell them how having this tax credit will help you and/or your community.

Contact your state senator and urge them to support HB1272 (Printer’s Number 1389) by asking their leadership to call it up for a vote. Ask them to vote YES once it reaches the Senate floor. Tell them how having this tax credit will help you and/or your community.

No comments yet.