File for a Stimulus Payment NOW Even if You Don’t Normally File Taxes!

File for a Stimulus Payment NOW Even if You Don’t Normally File Taxes!

If you didn’t receive one of the first two stimulus payments or didn’t receive the full amount, now’s the time to file a tax return. Even if you don’t normally file taxes, you should file for a stimulus payment right away.

There are two reasons why you should file your taxes now.

1. You could get money from the IRS even if you don’t have earnings!

The IRS has sent out two stimulus payments to help people get through the COVID-19 pandemic. The IRS has sent out $1,800 to most people so far: $1,200 in 2020, and $600 at the beginning of 2021. It started sending out the third payment of $1,400 on March 17, plus more money for children and dependent adults.

Most people with Social Security Numbers qualify for this money, but lots of people haven’t received all of the money they should have.

If you file your taxes this year, it will help you get all of the money you and your family are owed. It will also help you get future payments.

Here’s why you should file for a stimulus payment as soon as possible:

-

- If you don’t usually file taxes because you don’t have earnings from work or you get disability benefits, you might not have gotten all of the money you and your family are owed. You can get your stimulus payments by filing taxes now.

- The rules about who can get stimulus payments keep changing. Even if you did not qualify for a stimulus payment before, you might qualify for one now. You should file taxes to see if you are owed money, and to make it easier to get money in the future.

- If you lost your job or your income dropped in 2020, you should file taxes so the IRS has your recent income information. You might qualify for more money based on your lower income.

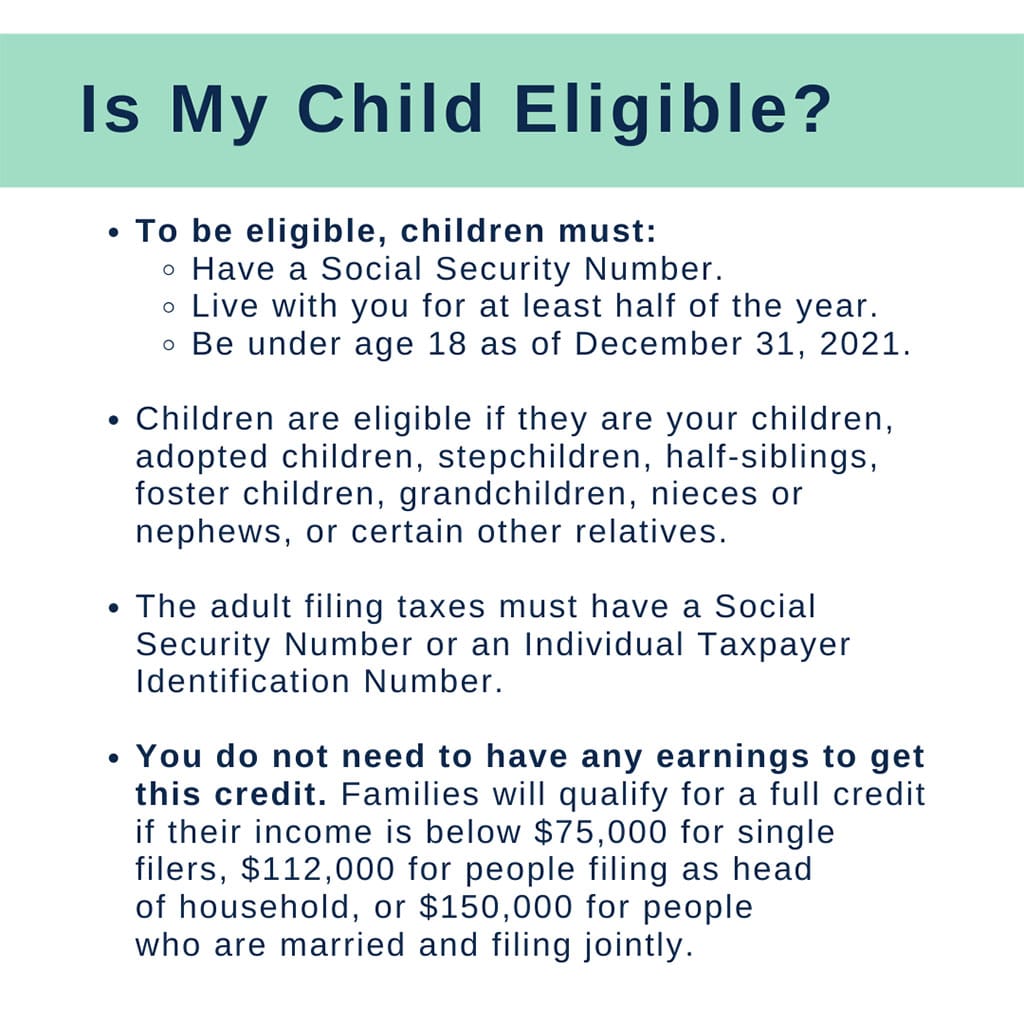

- If you have children living with you as of 2020, you may be eligible for another payment later in 2021. You can qualify for this money by filing your 2020 taxes.

2. You could get more money to support your children!

Pres. Biden’s American Rescue Plan, which Congress passed in March, expands the Child Tax Credit for 2021 to help struggling households with children.

How to file

You may not have to pay any money to file your taxes. Many people can get help for free.

- Learn more about free tax prep options.

- If you live in Philadelphia or the surrounding area, you may be eligible for free tax services from Campaign for Working Families. Go to their website to schedule either an in-person or virtual appointment.

- File your own taxes for free at MyFreeTaxes.com or GetYourRefund.org

I love Just Harvest and Pray it never go away!!!