You can read PBPC’s full list of what’s in the latest version of the Tax Bill. It was passed earlier this month in the U.S. Senate by 51 Republicans (with 1 Republican and all 48 Democrats opposed).

To summarize:

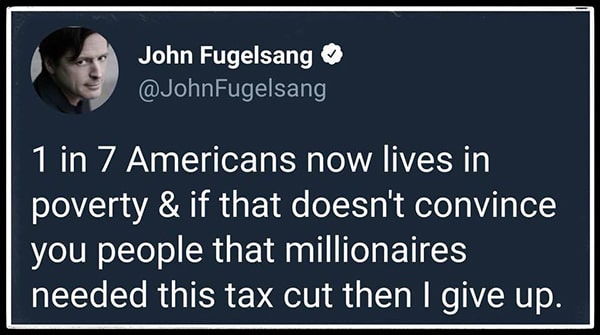

- The bill’s enormous tax cuts will mainly go to the businesses owned by the wealthiest 1% of Americans. All tax cuts for individuals will expire by 2027. At that time, taxes for the 2/3 of Americans earning $75k/year or less will go up on average. That same year, 60% of millionaires and billionaires will continue to get a tax cut.

- There is no evidence that giving huge tax breaks to the wealthy will stimulate our economy and create good-paying jobs. This “trickle-down” theory of wealth creation didn’t work under Regan, Bush senior, or, more recently, in Kansas. Instead of sticking the nation’s tax dollars in rich people’s bank accounts, our economy has grown most when we invest in infrastracture and education to raise earnings for the low- and middle-income people who will immediately spend them in our economy. (Not to mention the huge costs of hunger and poverty this prevents.)

- Despite their claims to the opposite only days ago, Republican leaders in D.C. (like our own Sen. Toomey) are already admitting that the $1 trillion+ cost of these tax cuts will cause huge deficits. This is now fueling their plans to slash spending on Medicaid and CHIP, Medicare, Social Security, and to drastically overhaul welfare programs like food stamps.

Republicans are right now meeting in conference committees in the Senate and House, and in private, to create a joint tax bill. Their leaders want each chamber to pass the final bill this month and send it to Pres. Trump for his signature.

HOW YOU CAN TAKE ACTION

Despite Republican control of both houses of Congress, we still have a chance to defeat this bill, or at least make it less horrific. Republicans disagree about some key elements of the legislation; they barely got the House and Senate versions passed.

So it’s critical we keep pushing key Republican U.S. Representatives in southeastern Pennsylvania – Costello, Dent, Meehan, and Fitzpatrick – to oppose the final tax bill.

![]() If you live in one of those districts, you can join thousands of other constituents who have contacted your members of Congress through this online tool.

If you live in one of those districts, you can join thousands of other constituents who have contacted your members of Congress through this online tool.

![]() If you don’t live in one of those districts and want to help defeat this bill, sign up to join phone banks to call constituents in the distict and ask them to call their representatives. (Thanks to Pennsylvania Health Access Network and PBPC for this.)

If you don’t live in one of those districts and want to help defeat this bill, sign up to join phone banks to call constituents in the distict and ask them to call their representatives. (Thanks to Pennsylvania Health Access Network and PBPC for this.)

No comments yet.