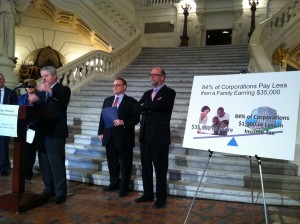

Better Choices for PA Coalition Released Plan in Harrisburg on Feb. 18

PITTSBURGH, PA – The Better Choices for Pennsylvania Coalition last week released a list of 19 recommendations to make Pennsylvania’s tax system fairer. State and local taxes require low- and middle-income workers to pay more of their income in taxes than the highest-income Pennsylvanians, making it hard to raise sufficient funds for vital human services, health care, public schools, and higher education.

“A recent study by the Institute on Taxation and Economic Policy named Pennsylvania the sixth most unfair state and local tax system for low- to moderate-income families. The recommendations we are making not only raise sustainable revenue for critical services like education and health care, but also make our tax system fairer for all Pennsylvanians,” said Michael Wood, research director at the Pennsylvania Budget and Policy Center, a member of the Better Choices Coalition. “Tax fairness can be achieved by raising some existing taxes, creating some new taxes, and providing targeted tax reductions for the low-income and the elderly. Our recommendations do that.”

The coalition’s push for tax fairness aligns with Gov. Tom Wolf’s Fresh Start campaign plan, which called for “income tax fairness for the middle-class” and “making sure all corporations doing business in Pennsylvania pay their fair share of taxes.”

The coalition’s recommendations include:

- Permanently closing most corporate tax loopholes by enacting combined reporting;

- Adopting a severance tax comparable to that imposed in West Virginia;

- Maintaining the sales tax exemption for all food items;

- Increasing the value of the Senior Citizen Property Tax Rent Rebate Program.

“Nearly 75% of Pennsylvania’s corporations pay a smaller percentage in taxes than many of the thousands of clients we see each year at our tax preparation program for low-income households,” Ken Regal, executive director of Just Harvest, said. “The state legislature and Gov. Wolf should correct the commonwealth’s embarrassingly regressive tax code. These changes will create revenue that can better serve all Pennsylvania citizens and grant much-needed relief to the 1.8 million Pennsylvania tax-payers who make less than $38,000 a year.”

The Better Choices Coalition is comprised of 35 organizations across the state committed to appropriate funding for education, health care, infrastructure, and human services to vulnerable Pennsylvanians and to investing in Pennsylvania’s families as a path to renewed prosperity.

The coalition’s other 14 recommendations are:

- Adopting a graduated tax rate, which would require a constitutional amendment;

- Adopting a personal exemption in the state income tax for individuals and couples;

- Expanding the Tax Forgiveness Program;

- Adding a refundable earned income tax credit to the state’s personal income tax, based on a percentage of the federal EITC;

- Revising laws to allow assessment of local property taxes on oil and gas reserves;

- Extending the Marketplace Fairness Act to downloadable music;

- Limiting the sales tax vendor discount;

- Enacting an alternative minimum corporate tax;

- Adopting a wealth tax on stocks and other investments;

- Imposing a higher tax on income from wealth, but not from work;

- Creating a property tax rebate program for working people;

- Giving low-income residents of rural areas a small tax credit to help offset higher gas taxes;

- Considering a financial transactions tax;

- Applying the cigarette tax to smokeless tobacco products and e-cigarettes.

For more information on the recommendations, visit betterchoicesforpa.com.

No comments yet.